Earn up to 5.60% APY1,

guaranteed

With market volatility rising and interest rates fluctuating, more retirement savers are turning to fixed annuities. SteadyPace™ locks in your return — so your savings stay protected, predictable, and set up for long-term growth.

Tax-deferred growth

No hidden fees or charges

Apply in 10 minutes online

A- (excellent) rating by AM Best2

Named a Top-Rated Annuity for 2025

Guaranteed rates up to

5.60% APY

Investment duration

Under $100,000

$100,000

and up

3 years

5.25%

5.55%

4 years

5.25%

5.55%

5-10 years

5.30%

5.60%

Earn more on the money you’ve worked hard to save

Make your money work harder. By choosing to deposit more, you get a higher guaranteed interest rate.

Trusted by thousands, backed by billions.

Confidence starts with trust — and Gainbridge® is a proud subsidiary of Group 1001, delivering security and transparency for long-term savers.

493,000+ issued annuity policies

Group 1001 has issued over 493,000 active annuity contracts across its family of companies.

4.5/5 stars on Trustpilot

Rated “Excellent” by real customers who value transparency, reliability, and results.

$72.9 billion in assets

Part of Group1001, which manages over $72.9 billion across trusted financial products.

A- (Excellent) AM Best rating

Rest assured with our strong financial stability recognized industry-wide.

"While I have industry experience, I found the language used to explain products to help me select the one very easy to understand. Completing the paperwork was a breeze - it was well laid out. The Company kept in communication with me every step along the way. This was a great experience and something I will recommend to others."

Lula Melisko3

How it works

Apply

Fill out a short, secure application in less than 10 minutes — no agent calls, no upsells, and no paperwork required.

Fund

Choose how you want to fund: transfer from a checking or savings account, send a check, or use a qualified transfer like an IRA, 401(k), or 1035 exchange.

Earn

Earn a fixed return with 24/7 online access, full transparency, and no market risk.

Frequently asked questions

What is the financial strength of Gainbridge®’s issuing insurance company?

Gainbridge Life is rated an A- (excellent) financial strength rating by AM Best, an insurance company.

A.M. Best Company assigns ratings from A++ to S based on a company’s financial strength and ability to meet obligations to contract holders. A- (Excellent) is the 4th highest of 16 ratings. For more information about the rating, visit www.ambest.com

Is Gainbridge® a reputable company?

Yes. Gainbridge® was founded in 2018 and is a proud subsidiary of Group 1001, which has approximately $72.9 billion of combined assets under management as of June 30, 2025.

Gainbridge Life is also rated A- (Excellent) by A.M. Best and rated "Excellent" on Trustpilot by Gainbridge® customers.

Who can I contact if I have questions?

You can contact Gainbridge®'s customer support team for assistance with your annuity. Call 1-866-252-9439 or email team@gainbridge.io. Our team is available Monday - Friday from 8AM to 5PM EST.

How are Gainbridge® rates so high?

By offering annuities directly, we eliminated the middleman, getting rid of hidden fees and commissions, putting more money back in your hands.

Is SteadyPace™ a good option for retirement savings?

SteadyPace™ offers a fixed interest rate, providing stability, guaranteed growth. With tax-deferred earnings and no market risk, it helps you build a secure financial foundation for retirement. Consider your overall strategy and goals to see if it fits your needs.

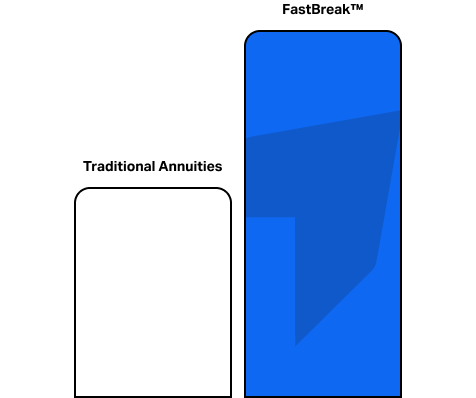

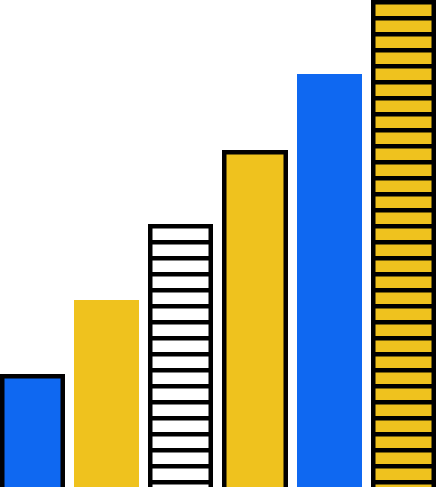

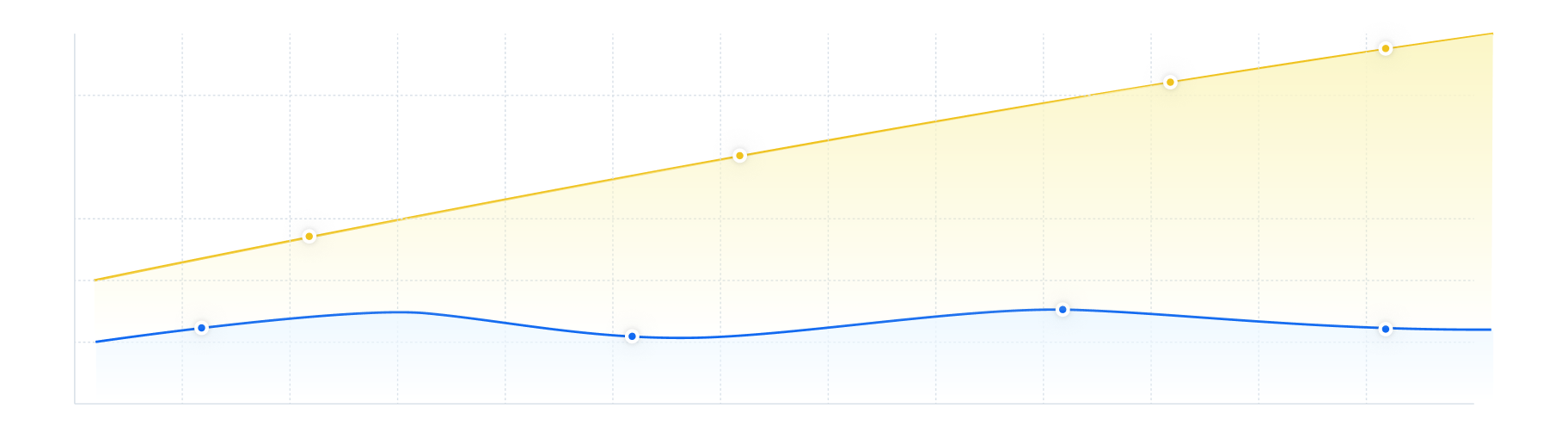

See how SteadyPace™ outperforms most MYGAs

“Great rate on the fixed rate annuity. Better than any bank CD. That got my business. Great company rating. Easy, easy sign up — sent them a check and done.” — Verified customer review on Trustpilot

Regular MYGAs

National average APY around 4.83%4

Often includes 3%+ broker commissions5

May require in-person meetings and paperwork

Limited visibility into your account

Gainbridge SteadyPace™

Up to 5.60% APY, guaranteed for your full term

No commissions or hidden fees

Quick & straightforward online application

24/7 online access — manage your account anytime

A new kind of annuity for today’s saver

With Gainbridge, you get everything traditional annuities promise — with less hassle and better rates.

Guaranteed growth for your savings

Turn your retirement savings into predictable growth —guaranteeing you’ll be growing your investment over time.

Rates higher than most annuities

SteadyPace™ offers up to 5.60% APY — above the national average MYGA rate of 4.83% APY.

Always on

Track your balance, see your growth, and manage your annuity — all from your Gainbridge dashboard.

100% principal protection

Your principal is never at risk — even if the market drops or rates change.

Calculate your growth

Use the SteadyPace™ calculator to see how much you can earn.

Grow smarter. Retire stronger.

SteadyPace™ gives you predictable growth, full control, and the confidence to plan ahead.

.avif)

Build your savings tax-deferred

With SteadyPace™, you don’t pay taxes on earnings until you withdraw.6 That means more of your money stays invested — helping you plan retirement income with confidence.

.avif)

Lock in retirement income with fixed annuity rates

Lock in your growth — up to 5.60% — for the full term of your annuity. No market exposure, no surprises. Just steady, predictable growth you can count on.

.avif)

Earn more with a commission-free MYGA

Most MYGAs are sold through brokers. Gainbridge isn’t. That means no commissions, no middlemen, and no markups — just a fixed return you keep

.avif)

Guaranteed growth with as little as $1,000

You don’t need to be wealthy to start saving with Gainbridge. Open an annuity with as little as $1,000 — no upsells, no calls, no pressure.

Plan your retirement with confidence — and a guaranteed return

Whether you're getting ready for retirement, rolling over a 401(k), or simply looking for guaranteed returns without market risk, SteadyPace™ offers a straightforward way to grow your money with confidence.

Guaranteed growth with tax-deferred benefits.

Guaranteed 5.60% APY — no market risk

Tax-deferred compounding over 3 to 10 years

May be ideal for retirement-focused planning without volatility

Start earning up to 5.60% APY with SteadyPace™

Open your account in minutes and lock in a guaranteed return, starting with 30 days to cancel risk-free and get a full refund.

No hidden fees, no commissions

A- (Excellent) rating for financial strength

30-day money-back guarantee if you change your mind

.avif)

.svg)